By Fast Business Line Team

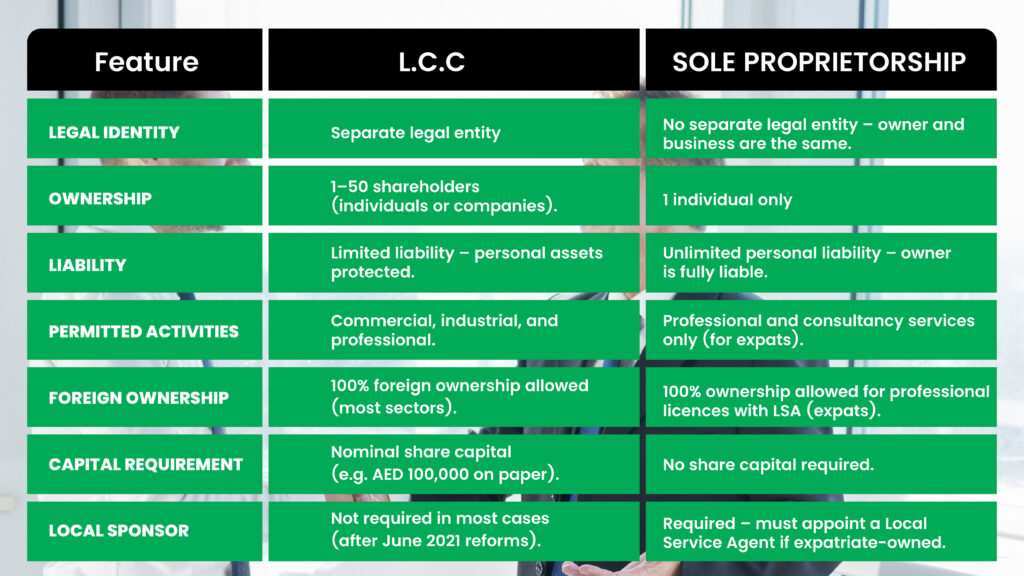

- When launching a business in Dubai, one of the first key decisions you’ll make is choosing the right legal structure. Two of the most common options for entrepreneurs are the Limited Liability Company (LL) and the Sole Proprietorship.

- Sole establishments and LLCs are two of the UAE’s most popular business entity structures.

- Each structure comes with its own set of features, legal implications, benefits, and requirements. At Fast Business Line, we specialize in guiding startups and professionals through the company formation process in the UAE. This article compares LLC and sole proprietorship to help you make an informed decision for your business.

What is a Limited Liability Company (LLC)

- An LLC is a flexible business model where company that exists as a separate legal entity from its owners (shareholders).

- LLCs allow for easier expansion through options like inclusion of partners or outside investment that are restricted under a sole proprietorship. This makes the LLC format a better fit for ventures targeting long term growth and scale

- 1 or more partners share the business ownership.

- You’re only responsible for losses up to your investment amount.

- Personal assets are protected from company debts and lawsuits.

- 100% foreign ownership is allowed for most activities since June 2021 (on the mainland).

Pros and Cons of an LLC in Dubai :

Pros :

Limited liability: Protects your personal assets from business debts or legal claims.

Broad activity scope: Trade, industrial, or professional services are all allowed.

Multiple shareholders: You can raise capital, onboard partners, or sell shares easily.

Business continuity: LLCs can continue if ownership changes or a founder exits.

Full foreign ownership: Most sectors now allow 100% foreign ownership on the mainland.

Access to local tenders: Only mainland LLCs can bid for government contracts.

Visa flexibility: You can sponsor multiple staff, based on office size.

Cons :

Higher costs: Setup and renewal fees are typically more than a sole proprietorship.

More admin: MOA, resolutions, and financial reporting increase regulatory overhead.

Office required: A physical address is mandatory, which adds to rent costs.

Complex closure: Dissolving an LLC requires formal liquidation, which can take months.

Potential partner issues: Shared ownership introduces the risk of disputes if not managed clearly.

Pros and Cons of a Sole Proprietorship in Dubai :

Pros :

Full control: One owner with 100% profit and decision-making authority.

Fast setup: Fewer documents, no MOA, and quicker licence issuance.

Lower costs: Startup and renewal fees are generally lower than for LLCs.

No capital required: No need to deposit share capital or declare a minimum investment.

Simple finances: Profits are treated as your personal income (though still subject to corporate tax).

100% ownership in professional activities: Foreigners can fully own professional licences with an LSA.

Ideal for low-risk fields: Great for solo consultants and freelancers with minimal liability exposure.

Cons

Unlimited liability: You’re personally liable for business debts and lawsuits.

Difficult to scale: No shares to sell or equity to offer investors, limits funding potential.

Perception issues: May be viewed as less formal by large clients and banks.

No continuity: The business ends if the owner leaves, passes away, or becomes incapacitated.

LSA requirement for expats: Foreigners need a UAE national agent, adding annual cost and dependency.

Office required: You still need an Ejari-registered space, even for small operations. Limited expansion: Cannot open branches or operate multiple activities under one licence.

Benefits of Choosing a Sole Proprietorship

- Fast and easy registration process

- Ideal for individuals looking to start small

- Lower costs and minimal compliance requirements

- Full control over decisions and profits

- Simple winding-up process

What You’ll Need to Register?

For a Sole Proprietorship in Dubai:

- Passport copy of the owner

- Proof of business address

- Local sponsor details (for foreign nationals)

- KYC documents

- Bank account details

For an LLC in Dubai:

- Passports and IDs of partners

- LLP agreement or deed

- Proof of office address

- No Objection Certificate (NOC) from the landlord

- Bank statements of partners

Get Started with Fast Business Line

At Fast Business Line, we help you navigate the setup process from start to finish. Whether you choose a sole proprietorship for flexibility or an LLP for shared ownership with limited liability, our team ensures your company is established quickly and in compliance with UAE regulations. Looking to start your business in Dubai?

📞 Contact us today and let’s make your business journey smooth and successful.